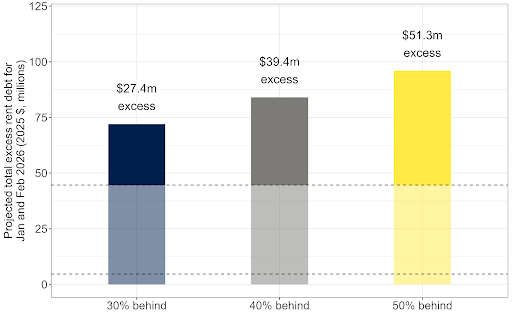

Metro Surge Drives $27–51M Excess in MN Rent Debt

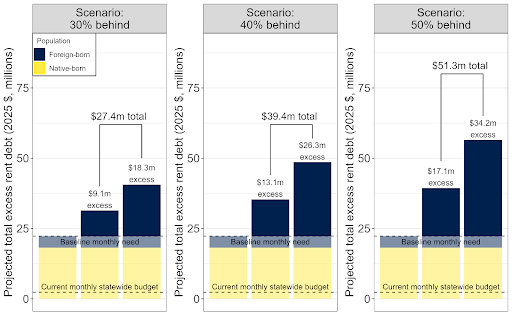

Projected total excess rent debt since Metro Surge began given different scenarios about the proportion of immigrant households behind on rent in Jan. and Feb. 2026, stratified by month.

From the CURA at UMN:

New research from the Center for Urban and Regional Affairs (CURA) indicates that the Department of Homeland Security's Operation Metro Surge has significantly increased the burden of rent debt on immigrant households across Minnesota, particularly within communities that are already facing high housing costs. Researchers estimate that excess statewide rent debt linked to the operation reached between $27.4 million to $51.3 million by February 2026 — on top of the $44.6 million in rent debt typically expected during any two-month period.

Prior to Operation Metro Surge, statewide rent debt - the total amount of unpaid rent that househods collectively owe at a given time - among low-imcome households averaged $22.3 million per month, roughly ten times higher than Minnesota's monthly emergency rental assistance budget of about $2.3 million. The additional debt reflects lost income, missed work hours, and increased economic instability following the operation's launch on December 4, 2025, and the ongoing toll on families who are most at-risk of targeting by the U.S. Immigration and Customs Enforcement (ICE) and other federal agents.

Since December, thousands of Minnesotans have reported disruptions to employment. Some workers have missed shifts due to safety concerns commuting or remaining ICE activity, while others have experienced reduced hours or household income losses linked to detention or deportation of wage earners. Housing advocates warn that these pressures are intensifying an already fragile housing landscape.

Immigrant households are disproportionately affected. When compared with similar non-immigrant households, immigrant renters tend to have lower incomes yet face higher rents; 71% of immigrant households earning under $75,000 annually are rent-burdened, spending more than 30% of their income on housing. Missed rent payments in January and February 2026 have increased eviction risks for many families statewide.

While it is extremely difficult to identify exactly how many households have lost wages as a consequence of federal operations, we estimate that 30–50% of immigrant renters may be at least one month behind on rent by February 2026. The lower-range estimate reflects conditions outside Minneapolis and comparisons to pandemic-era data, including the October 2021 Household Pulse Survey, which found 21% of Latinx households and 25% of Black households behind on rent. The higher-range estimates take into consideration sources of data such as surges in calls to hotlines for rental assistance, the share of public school families who have opted into virtual learning, and the sheer volume of applications for assistance received by community mutual aid funds.